Your browser doesn’t support HTML5 audio

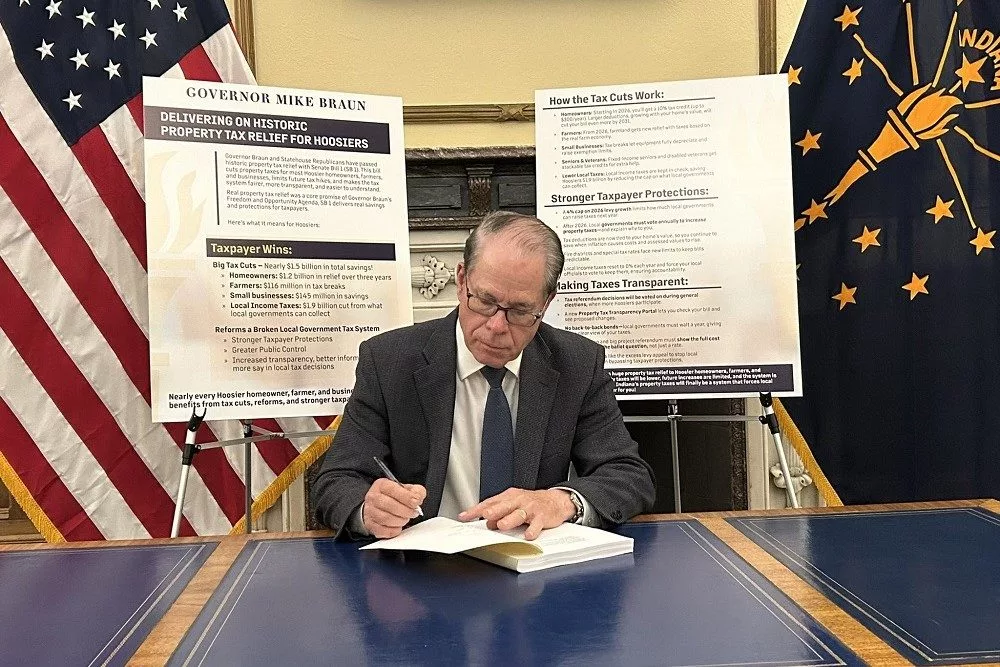

A lot of time was spent breaking down SB1 last year, what we can now officially call the Braun Tax Reform Bill. But the question remains: is this bill good for farmers? Purdue Professor Emeritus Larry Deboer, who has worked on Indiana tax policy for decades, says, “It depends.”

“It’s possible that farmers will pay less than they pay now. It’s possible that they’ll see an increase, but probably less of an increase than anybody else is likely to see.”

Deboer says homeowners whose homestead has an assessed value below $102,000 dollars certainly won’t be happy with the bill. The elimination of the fixed standard deduction of $48,000 right off the top is the culprit.

“$48,000 is pretty significant chunk of a home valued at $100,000, right? That’s almost half. It turns out that the deduction that they’re going to have in 2031 is about two-thirds. If you take the $48,000 plus the supplemental deduction we’ve got now, which is 37.5, that’s about three-quarters.”

So, for those homes, the deduction by 2031 will be less than it is now, which means your taxes will go up.

This could hit rural communities across the state hard if a change isn’t made. Deboer showed his research at last week’s Indiana Farm Bureau Legislative Forum that showed property taxes nearly tripling for some homeowners in Jay County based on his research.

“And in Jay County, about one-third of all the homesteads are valued at less than $80,000. So, less than $100k, even more than that. So, yes, in rural areas, homes valued in five figures are pretty common. Certainly folks in the suburbs and the cities might find that hard to believe but take a look at the selling prices of homes in rural areas. That’s what the assessor is basing their assessments on, and those homes frequently sell for less than $100,000.”

While several bills have been introduced that could change portions of now Senate Enrolled Act 1, Braun told Indianapolis news station WIBC that we won’t get anything on property taxes until, “we open up the budget in ’27.”